Sales tax calculations are a critical aspect of any business’s accounting processes. QuickBooks, a popular accounting software, is often the go-to solution for managing such tasks. However, users may occasionally encounter a sales tax rounding error in QuickBooks that can lead to discrepancies in financial records. This blog will delve into the causes, impacts, and solutions to the QuickBooks sales tax rounding error, ensuring your financial data remains accurate and compliant with tax regulations.

Understanding QuickBooks Sales Tax Rounding Error

A sales tax rounding error in QuickBooks typically occurs when the software calculates sales tax amounts to a fraction of a cent, which cannot be represented in monetary transactions. These discrepancies can arise due to variations in:

- Sales tax rates: Decimal-based tax rates often lead to fractional results.

- Item prices: Taxable items priced in decimals can result in rounding differences.

- Invoice totals: Aggregating multiple taxable items can amplify minor rounding errors.

For example, if an item priced at $19.99 is taxed at 7.25%, the sales tax calculated is $1.449775, which QuickBooks might round to $1.45 or $1.44 based on its algorithms.

Causes of Sales Tax Rounding Errors

1. Decimal Precision in Sales Tax Rates

Sales tax rates are often defined to multiple decimal places (e.g., 7.125%). QuickBooks rounds these calculations to two decimal places to fit currency constraints, potentially causing rounding discrepancies.

2. Cumulative Calculation Errors

When multiple items are taxed together, the software calculates sales tax on individual items and then aggregates them. This can lead to slight differences when compared to calculating tax on the total invoice amount.

3. Mismatch in Rounding Methods

QuickBooks uses a specific rounding methodology (up or down to the nearest cent). Differences between QuickBooks and your local tax authority’s rounding methods can lead to mismatches.

4. Custom Tax Settings

Users customizing tax rules or applying specific tax rates manually might inadvertently introduce rounding errors, especially when combining taxable and non-taxable items.

Impacts of Sales Tax Rounding Errors

1. Financial Discrepancies

Rounding errors, though minor on individual transactions, can accumulate over time, leading to discrepancies in:

- Tax payable reports

- Financial statements

- Reconciliation processes

2. Compliance Issues

Tax authorities expect precise tax reporting. Persistent discrepancies could trigger audits, penalties, or additional scrutiny from tax agencies.

3. Customer Dissatisfaction

Inconsistent tax calculations on invoices might raise questions from customers, impacting your business’s reputation.

4. Reconciliation Challenges

Reconciling tax liabilities with tax reports can become challenging when recurring rounding errors exist.

How to Identify QuickBooks Sales Tax Rounding Error

1. Review Detailed Reports

Check the “Sales Tax Liability Report” for discrepancies between tax collected and tax payable.

2. Audit Invoices

Compare the tax calculated on individual invoices against expected amounts based on local tax rates.

3. Use Reconciliation Tools

QuickBooks offers tools for reconciling accounts. Use these to detect and address rounding issues.

4. Run Custom Reports

Generate custom reports focusing on sales tax discrepancies to pinpoint problematic transactions.

Solutions to QuickBooks Sales Tax Rounding Error

1. Adjusting Sales Tax Settings

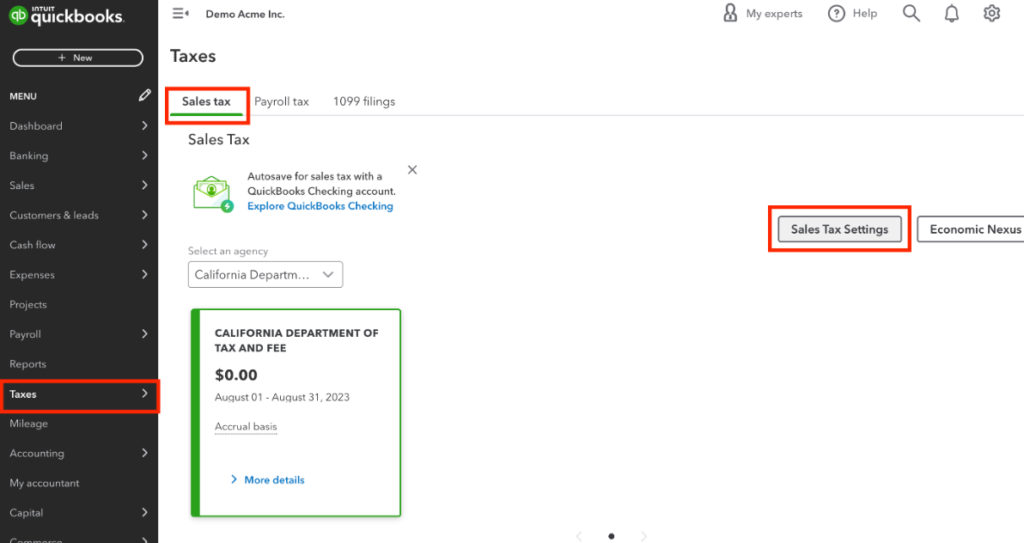

Ensure the sales tax setup in QuickBooks matches local tax regulations. Navigate to:

- Taxes > Sales Tax Settings to review and update rates.

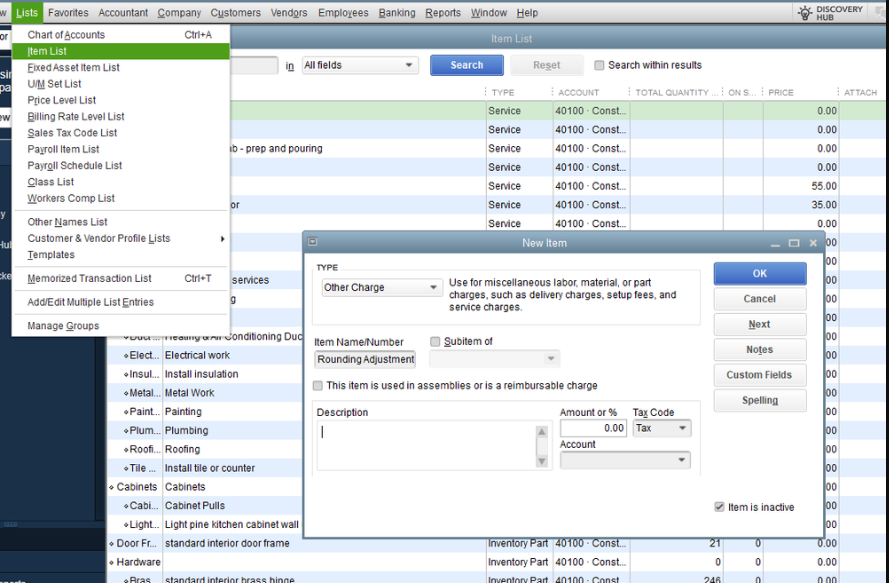

2. Using Rounding Adjustments

QuickBooks allows manual adjustments to align tax amounts with expected values:

- Edit the invoice or sales receipt.

- Add a “Rounding Adjustment” line item to correct discrepancies.

3. Reviewing Preferences

Adjust rounding preferences to minimize discrepancies:

- Go to Edit > Preferences > General > Rounding Preferences.

- Choose an appropriate rounding method (up, down, or nearest).

4. Updating QuickBooks

Ensure your QuickBooks software is updated to the latest version. Updates often include bug fixes and improved calculation methods.

5. Engaging a QuickBooks ProAdvisor

Certified QuickBooks ProAdvisors can help review your setup, identify recurring errors, and implement advanced solutions.

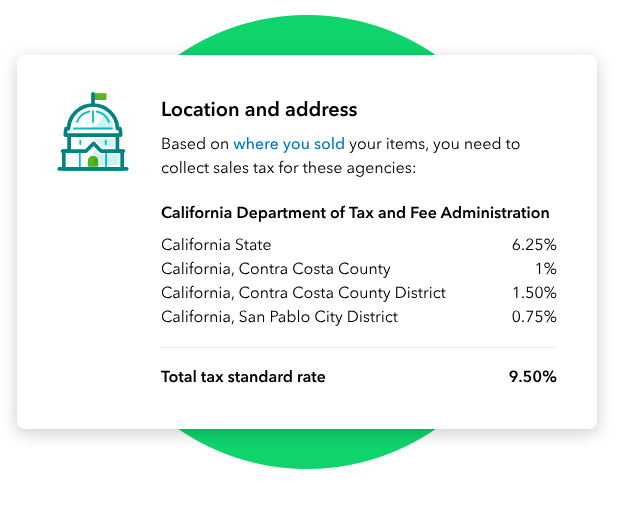

6. Switching to Automated Sales Tax

QuickBooks Online offers an automated sales tax feature:

- Automatically calculates taxes based on the customer’s location.

- Minimizes manual errors and discrepancies.

Preventing Future Sales Tax Rounding Errors

1. Regular Software Updates

Keep QuickBooks updated to leverage improved tax calculation features.

2. Standardizing Tax Rates

Avoid using overly complex tax rates that increase the risk of rounding errors.

3. Training Staff

Ensure your team understands how QuickBooks calculates sales tax and the importance of accurate data entry.

4. Periodic Audits

Conduct regular audits of your sales tax records to identify and address discrepancies early.

5. Using Integrated Tools

Consider integrating third-party tax calculation tools that specialize in precise tax compliance.

Conclusion

QuickBooks’ sales tax rounding errors, while minor on a per-transaction basis, can escalate into significant issues if left unchecked. By understanding the causes, impacts, and solutions outlined above, businesses can ensure accurate tax calculations and maintain compliance with local regulations. Leveraging QuickBooks’ features, staying updated, and conducting regular audits are essential steps toward minimizing rounding discrepancies.

FAQs about QuickBooks Sales Tax Rounding Error

QuickBooks uses specific rounding algorithms that may differ from those of your local tax authority. This can lead to minor discrepancies, particularly with decimal-based tax rates.

Yes, QuickBooks allows you to manually adjust sales tax amounts on invoices or receipts by adding a rounding adjustment line item.

To prevent errors, standardize tax rates, update software regularly, and use QuickBooks’ automated sales tax feature for accurate calculations.

Review your sales tax settings, audit individual transactions, and consider consulting a QuickBooks Data Service Helpline at +1-888-538-1314 to resolve recurring issues.

Yes, QuickBooks’ automated sales tax feature is designed to minimize errors by calculating taxes based on customer locations and applicable tax rules.