QuickBooks is widely recognized as one of the most reliable accounting software solutions for small and medium-sized businesses. Its robust features simplify complex accounting processes, including tax calculations. However, like any other software, QuickBooks isn’t immune to occasional glitches. One common issue users report is, “QuickBooks encountered an error while calculating tax.”

In this blog, we will explore the causes of this issue, potential solutions, and best practices to avoid encountering this problem in the future.

Understanding the Tax Calculation Error in QuickBooks

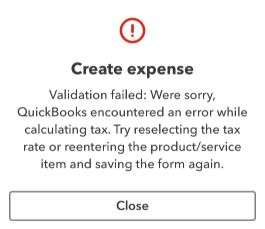

Tax calculation errors in QuickBooks occur when the software is unable to correctly compute sales tax or other tax-related values. This can disrupt workflows, cause inaccuracies in financial records, and delay critical processes like invoicing or filing tax returns.

While QuickBooks automates tax computations, the accuracy of these calculations depends on several factors, such as proper configuration, system updates, and the integrity of data files.

Common Causes of Tax Calculation Errors in QuickBooks

- Incorrect Tax Settings: Misconfigured tax rates or codes in QuickBooks can lead to calculation errors. For instance, if the sales tax rate for your region has changed and hasn’t been updated in QuickBooks, the software may generate incorrect tax amounts.

- Damaged or Corrupt Company Files: A damaged QuickBooks company file can lead to inconsistencies in various functionalities, including tax calculations.

- Outdated QuickBooks Version: Running an outdated version of QuickBooks can cause compatibility issues, especially if the software lacks the latest updates or bug fixes related to tax computations.

- Third-Party Integration Conflicts: Integration with third-party applications or plugins may interfere with QuickBooks’ tax calculation processes, especially if those tools have errors or compatibility issues.

- Improper Sales Tax Item Setup: Incorrect setup of sales tax items or groups can result in calculation discrepancies.

- Network or Connectivity Issues: For QuickBooks Online users, connectivity problems can disrupt tax calculations, especially when syncing data or applying real-time tax rates.

- User Errors: Manual entry mistakes, such as selecting the wrong tax code or inputting incorrect amounts, can lead to calculation issues.

How to Identify the Tax Calculation Error in QuickBooks

Before attempting to fix the issue, you need to identify the root cause. Here are a few steps to help:

- Check Error Messages: Look for error messages or codes displayed by QuickBooks while calculating taxes. These messages often provide clues to the underlying issue.

- Review Sales Tax Settings: Navigate to the sales tax settings to ensure that all tax rates and codes are correctly configured.

- Audit Recent Transactions: Review recent transactions to identify any discrepancies in tax calculations.

- Inspect Third-Party Apps: If you use third-party integrations, check whether they’re functioning correctly or causing conflicts.

Solutions to Fix the Tax Calculation Error in QuickBooks

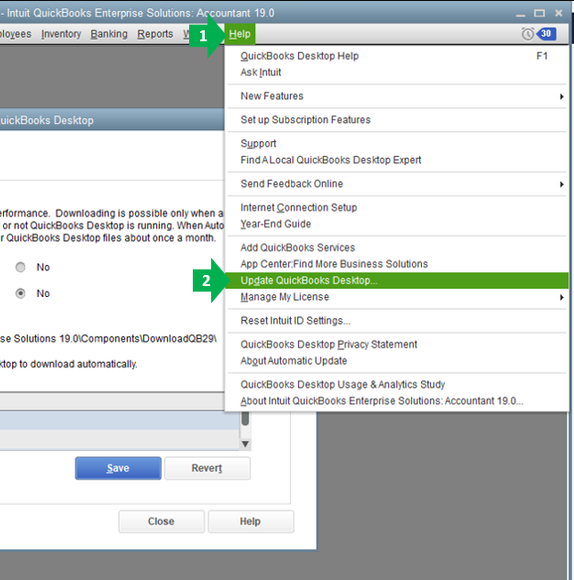

1. Update QuickBooks to the Latest Version

Keeping QuickBooks updated ensures that you’re running the latest version with all bug fixes and updates. Here’s how you can update QuickBooks:

- Open QuickBooks Desktop.

- Go to the Help menu and select Update QuickBooks Desktop.

- Click on Update Now, then select Get Updates.

- Restart QuickBooks once the update is complete.

For QuickBooks Online users, the software is updated automatically.

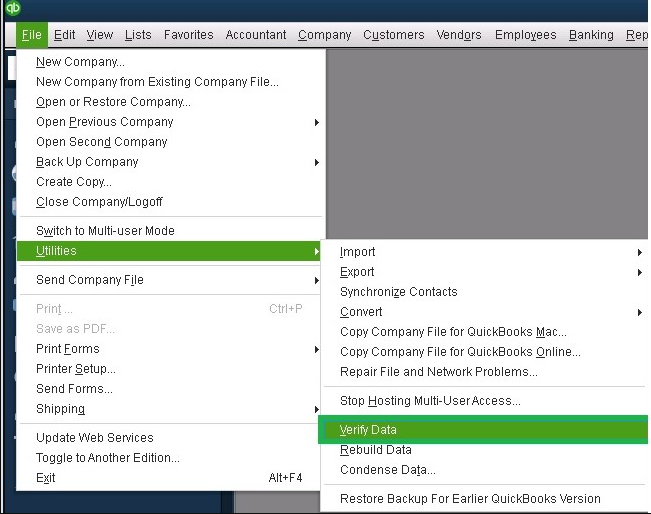

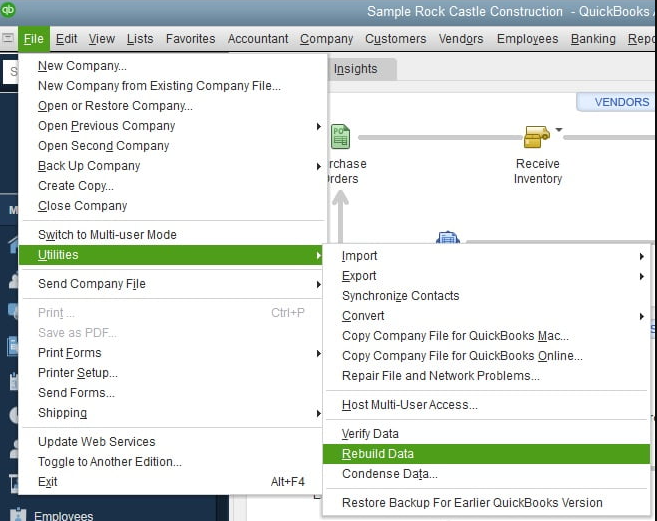

2. Verify and Rebuild Data

If the issue is related to data corruption, use the Verify and Rebuild Data tools:

Go to the File menu, then select Utilities > Verify Data.

If QuickBooks finds any issues, go to File > Utilities > Rebuild Data.

Follow the on-screen instructions to complete the process.

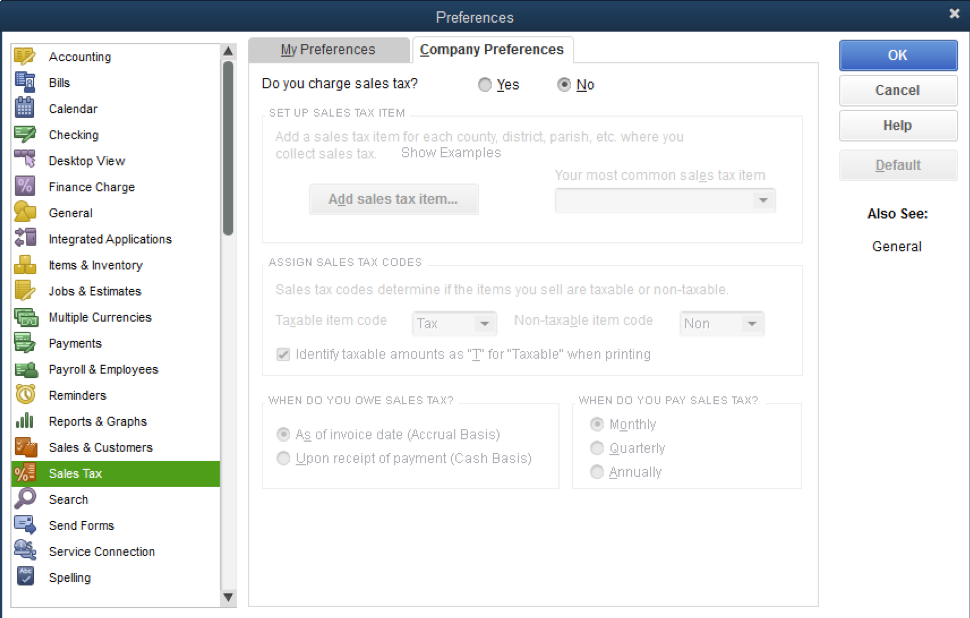

3. Check and Configure Sales Tax Settings

Ensure that your sales tax settings are properly configured:

- Go to Edit > Preferences and select Sales Tax from the left menu.

- Verify the tax rates and ensure they match your state or local requirements.

- Update any outdated tax rates.

4. Resolve Third-Party Conflicts

If you suspect a third-party integration is causing the issue:

- Temporarily disable the third-party app.

- Check if the error persists in QuickBooks.

- Update or reconfigure the third-party app to resolve compatibility issues.

5. Manually Recalculate Taxes

If the automated calculation fails, you can manually compute taxes for affected transactions:

- Open the transaction in question (e.g., invoice or sales receipt).

- Calculate the tax amount using an external tool or formula.

- Enter the correct tax amount manually.

6. Contact QuickBooks Support

If you’re unable to resolve the issue, contact from QuickBooks Data Service Helpline at +1.888.538.1314 for assistance. Provide them with detailed information about the error, including any error messages and steps you’ve already tried.

Best Practices to Avoid Tax Calculation Errors

- Regularly Update Tax Rates: Stay informed about changes to sales tax rates in your region and update them in QuickBooks promptly.

- Maintain Data Integrity: Regularly back up your company files and use the Verify Data tool to check for errors.

- Limit Manual Entries: Reduce the risk of user errors by automating as many processes as possible.

- Train Your Team: Ensure that all team members are trained in using QuickBooks effectively and understand how to manage sales tax settings.

- Test Third-Party Integrations: Before fully integrating a third-party app, test its compatibility with QuickBooks to avoid conflicts.

Conclusion

Tax calculation errors in QuickBooks can be frustrating, but they are often easy to resolve with the right approach. By understanding the common causes, following the troubleshooting steps outlined in this guide, and adhering to best practices, you can ensure smooth and accurate tax computations in QuickBooks.

However, if the issue persists, don’t hesitate to seek professional assistance. A QuickBooks ProAdvisor or a certified accountant can provide expert guidance tailored to your specific needs.

FAQs

QuickBooks may encounter tax calculation errors due to incorrect tax settings, data corruption, outdated software, or conflicts with third-party integrations.

You can fix sales tax calculation errors by updating QuickBooks, verifying and rebuilding data, reconfiguring sales tax settings, resolving third-party conflicts, or contacting QuickBooks Support.

Yes, QuickBooks Online automatically updates sales tax rates based on your location. For QuickBooks Desktop, you need to manually update tax rates.

Use the Verify and Rebuild Data tools in QuickBooks to identify and repair data corruption. If the issue persists, restore a backup or consult a professional.

Yes, you can manually override tax amounts in QuickBooks by editing the specific transaction and entering the correct tax value.